sales tax calculator reno nv

Sales Tax Calculator in Reno NV. Nevada Dealer Sales - Taxes are paid to the dealer based on the actual purchase price.

Sales Taxes In The United States Wikiwand

2385 Painted River Trl Reno NV 89523-2874 2599000 MLS 220005462 Market Adjustment.

. Nevada collects a 81 state sales tax rate on the purchase of all vehicles. Rates include state county and city taxes. Every 2020 q4 combined rates mentioned above are the results of nevada state rate 46 the county rate 3665.

Rachel nv sales tax rate. Real property tax on median home. The December 2020 total local sales tax rate was also 8265.

In addition to taxes car purchases in Nevada may be subject to other fees like registration title and plate fees. The latest sales tax rates for cities starting with R in Nevada NV state. 89501 89502 89503.

Auto Sales Tax Calculator Nevada. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Round Mountain NV Sales Tax Rate.

This is the total of state county and city sales tax rates. The base state sales tax rate in Nevada is 46. The sales tax rate does not vary based on zip code.

See the Nevada Department of Taxation Sales and Use Tax Publications for current tax rates by county. Apr 14 2020 The sales tax must be paid before you can receive a tag for the trailer. Local tax rates in Nevada range from 0 to 3665 making the sales tax range in Nevada 46 to 8265.

Motivated Seller has identified replacement property. This includes the sales tax rates on the state county city and special levels. Ruby Valley NV Sales Tax Rate.

3 beds 2 baths 1950 sq. For vehicles that are being rented or leased see see taxation of leases and rentals. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nevada local counties cities and special taxation.

There is no applicable city tax or special tax. The combined rate used in this calculator 46 is the result of the nevada state rate 46. The average sales tax rate in California is 8551.

The County sales tax rate is. Method to calculate Nevada City sales tax in 2021. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

The 8265 sales tax rate in Reno consists of 46 Nevada state sales tax and 3665 Washoe County sales tax. 2020 rates included for use while preparing your income tax deduction. Our Premium Cost of Living.

Wayfair Inc affect Nevada. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Reno NV. If youre an online business you can connect TaxJar directly to your shopping cart and instantly calculate sales taxes in every state.

Tax Attorneys Credit Debt Counseling Financing Consultants. Find your Nevada combined state and local tax rate. Name A - Z Sponsored Links.

Many dealers remit sales tax payments with the title paperwork sent to the DMV Central. Reno Back Tax Debt Relief. Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases.

The fee for a trailer tag is 12 If you buy a trailer online from an out-of-state source and the site or company collects a fee for processing the sale they become a broker for the sale and sales. Sales Tax State Local Sales Tax on Food. The Reno sales tax rate is.

5 beds 45 baths 4896 sq. Did South Dakota v. Local sales tax rates can raise the sales tax up to 8375.

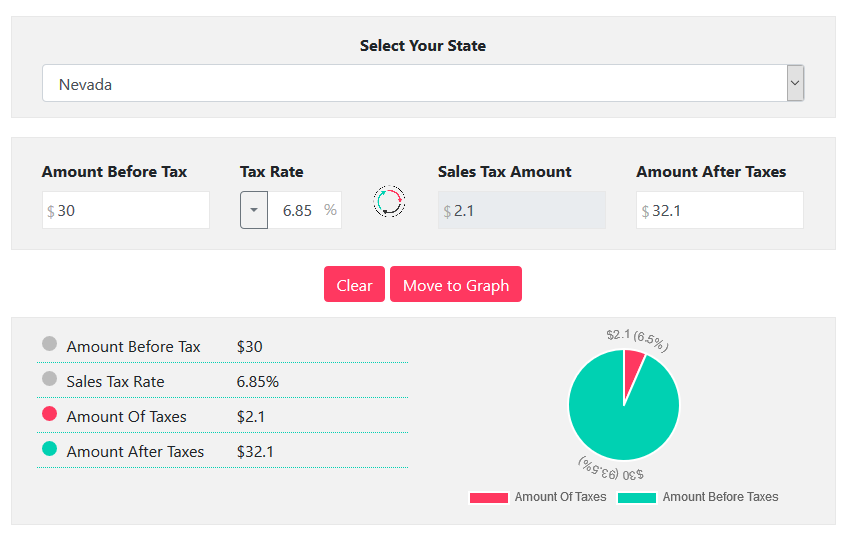

Nevadas statewide sales tax rate of 685 is seventh-highest in the US. 2022 Cost of Living Calculator for Taxes. You can use our Nevada Sales Tax Calculator to look up sales tax rates in Nevada by address zip code.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Reno is located within Washoe County Nevada. The minimum combined 2022 sales tax rate for Reno Nevada is.

Out-of-State Dealer Sales - An out-of-state dealer may or may not collect sales tax. Most transactions of goods or services between businesses are not subject to sales tax. Your household income location filing status and number of personal exemptions.

Nevada has a 46 statewide sales tax rate but also has 34 local tax jurisdictions including. The current total local sales tax rate in Reno NV is 8265. Within Reno there are around 23 zip codes with the most populous zip code being 89502.

SalesTaxHandbook visitors qualify for a free month by signing up via our partner program here. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. Sales Tax Table For Nevada.

All numbers are rounded in the normal fashion. Nevada sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. The reno nevada general sales tax rate is 46.

Some dealerships may also charge a 149 dollar documentary fee. The Reno Nevada sales tax rate of 8265 applies to the following 24 zip codes. The Nevada sales tax rate is currently.

10128 Quintana Dr Reno NV 89521-4509 695000 MLS 220007594 Immaculate Juniper model with exceptional curb appeal in Sage Meadow at Damonte Ranch. Reno NV Sales Tax Rate. To calculate the sales tax amount for all other values use our sales tax calculator above.

Sales Tax Calculator Sales Tax Table. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax.

The average cumulative sales tax rate in Reno Nevada is 827. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 795 in Nevada.

Canada Sales Tax Rates And Calculators 2022 Investomatica

Nevada Income Tax Calculator Smartasset

Nevada Income Tax Nv State Tax Calculator Community Tax

Nevada Income Tax Calculator Smartasset

Sales Taxes In The United States Wikiwand

Nevada Income Tax Nv State Tax Calculator Community Tax

Ifta Calculator Tax Software Cool Photos Tax

The Nevada Income Tax Rate Is 0 This Does Not Mean You Will Not Be Taxed On Your Earnings

How To Calculate Cannabis Taxes At Your Dispensary

Total Sales Tax Rate Nevada Turbotax Sema Data Co Op

Nevada Vs California Taxes Explained Retirebetternow Com

Nevada Income Tax Nv State Tax Calculator Community Tax

Nevada Income Tax Nv State Tax Calculator Community Tax

Nevada Sales Tax Calculator Reverse Sales Dremployee

Nevada Income Tax Nv State Tax Calculator Community Tax

Nevada Income Tax Calculator Smartasset